Asia-Pacific Region Ultrasound Devices Market Insights 2025

Asia Pacific is expected to witness lucrative growth over the forecast period owing to supportive government initiatives for improving healthcare infrastructure in the region. The presence of a large population with low per capita income in Asia Pacific countries has led to a high demand for affordable treatment options.Let's dive deeper into Asia-Pacific ultrasound devices market size, technology (2D ultrasound imaging, 3D and 4D ultrasound imaging, doppler imaging, high-intensity focused ultrasound), geography (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific) and more.

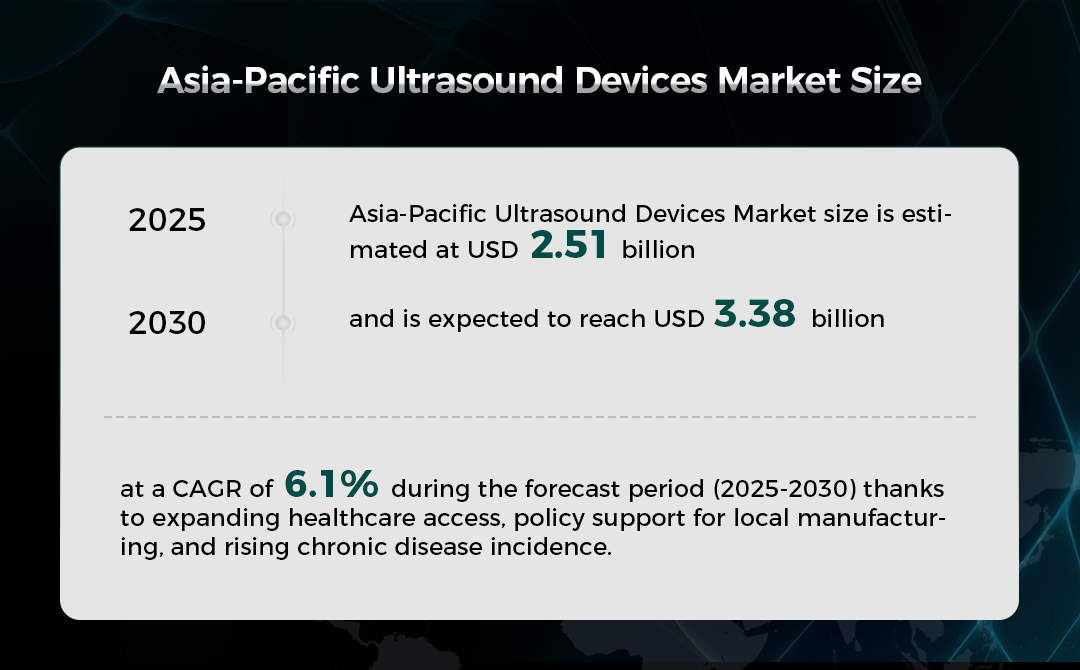

Asia-Pacific Ultrasound Devices Market Size

Asia-Pacific Ultrasound Devices Market size is estimated at USD 2.51 billion in 2025, and is expected to reach USD 3.38 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030)thanks to expanding healthcare access, policy support for local manufacturing, and rising chronic disease incidence according to sources.

Globally, Asia Pacific is projected to lead the regional market in terms of revenue in 2030.Asia Pacific dominated the market with a 41.23% share in 2024. This leadership is driven by higher sales volumes of ultrasound devices, as the region is a major manufacturer of cost-effective equipment.

Therapeutic Ultrasound Devices is the most lucrative product segment registering the fastest growth during the forecast period.

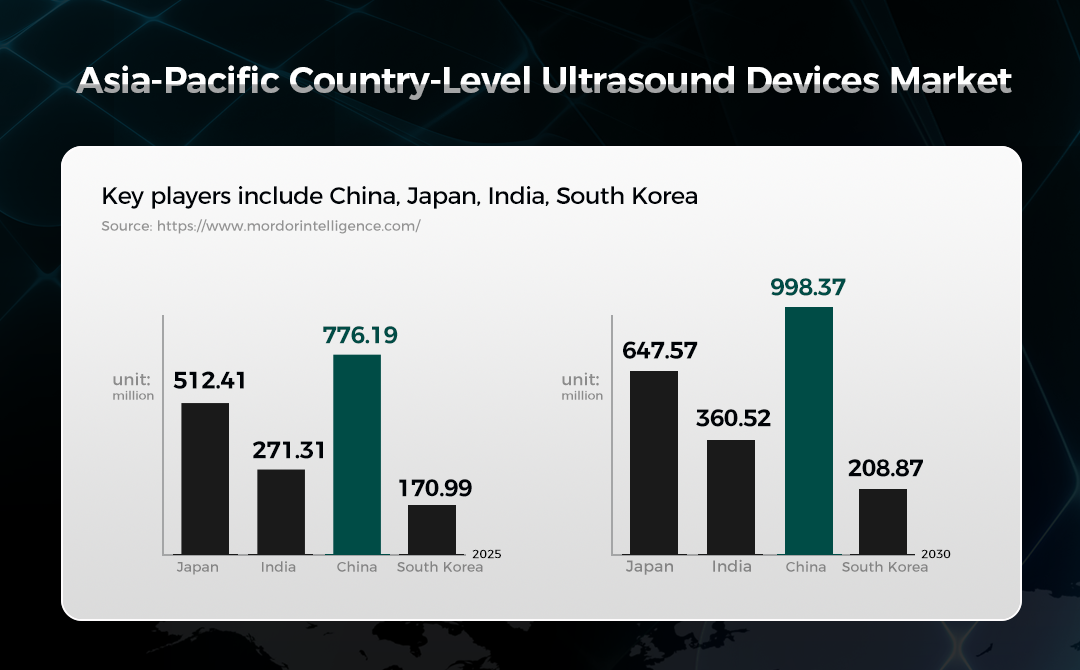

APAC Ultrasound Devices Market Driven by China and Japan

The China Ultrasound Devices Market size is estimated at USD 776.19 million in 2025, and is expected to reach USD 998.37 million by 2030, at a CAGR of 5.16% during the forecast period (2025-2030). Hospitals represented 48.25% of the China ultrasound devices market size in 2024, while ambulatory and day-care centers record an 8.37% CAGR to 2030. Stationary systems commanded 62.16% revenue share of the China ultrasound devices market in 2024, whereas handheld devices post the fastest 9.11% CAGR to 2030.

The Japan Ultrasound Devices Market size is estimated at USD 512.41 million in 2025, and is expected to reach USD 647.57 million by 2030, at a CAGR of 4.79% during the forecast period (2025-2030). By portability, stationary consoles accounted for 67.89% of Japan ultrasound market size in 2024, whereas handheld devices are growing at 8.03% CAGR through 2030. Japan: As a key country in the dominant Asia Pacific region, Japan's market is driven by a high demand for advanced diagnostic equipment in its well-established healthcare system. The presence of major domestic players also contributes to innovation and market growth.

The India Ultrasound Devices Market size is estimated at USD 271.31 million in 2025, and is expected to reach USD 360.52 million by 2030, at a CAGR of 5.85% during the forecast period (2025-2030). India ultrasound devices market continues to benefit from policy-backed infrastructure spending that lifts public and private procurement across tier-1 and tier-2 cities. Hospitals held 52.85% share of the India ultrasound devices market in 2024, but Ambulatory Surgical Centres are forecast to expand at a 4.49% CAGR during the outlook period.

The South Korea Ultrasound Devices Market size is estimated at USD 170.99 million in 2025, and is expected to reach USD 208.87 million by 2030, at a CAGR of 4.08% during the forecast period (2025-2030). South Korea’s population aging past 20% over 65 in 2025 ensures long-term imaging demand, although sonographer shortages and strict regulatory pathways temper near-term growth as source from mordorintelligence.

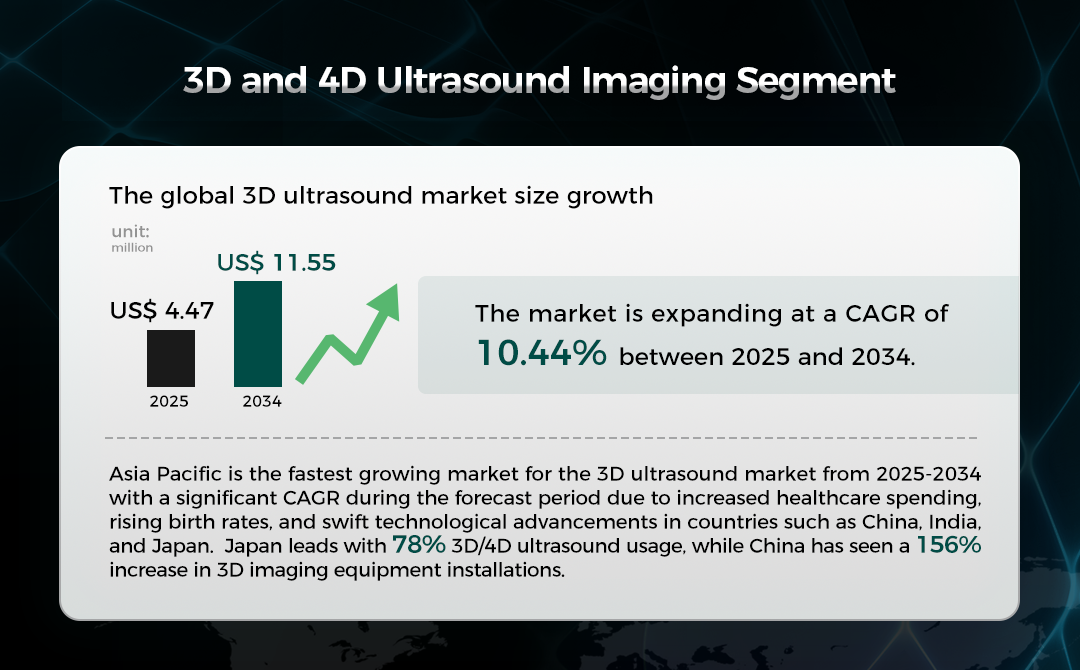

3D and 4D Ultrasound Imaging Segment

The growing use of 3D/4D imaging technology in medical diagnostics, surgery planning and personalized medicine is fueling rapid expansion.Global 3D ultrasound market size grew to US$ 4.74 billion in 2025, and is projected to reach around US$ 11.55 billion by 2034. The market is expanding at a CAGR of 10.44% between 2025 and 2034. Asia Pacific is the fastest growing market for the 3D ultrasound market from 2025-2034 with a significant CAGR during the forecast period due to increased healthcare spending, rising birth rates, and swift technological advancements in countries such as China, India, and Japan.Japan leads with 78% 3D/4D ultrasound usage, while China has seen a 156% increase in 3D imaging equipment installations.

Collaborations between global manufacturers and local innovations are enhancing the availability of advanced ultrasound systems, making the Asia Pacific region a vibrant and appealing area for investment in 3D ultrasound technology.

Countries such as Japan and China are aggressively investing in advanced imaging systems, with China's healthcare spending expected to top USD 1.5 Trillion by 2023, driving up demand for 3D/4D solutions in the healthcare business.The use of 3D/4D imaging in healthcare, particularly for surgical planning, is quickly rising. In 2023, the Asia Pacific healthcare sector will spend USD 2.7 Trillion, 18% of which will go toward medical imaging. Japan leads with 78% 3D/4D ultrasound usage, while China has seen a 156% increase in 3D imaging equipment installations.

Wrapping up

The ultrasound devices market in Asia Pacific is anticipated to exhibit significant growth over the forecast period. This can be attributed to rapid growth of the population and increased R&D activity in this region. The presence of a large population with low per capita income in Asia Pacific countries has led to a high demand for affordable treatment options. In addition, there is a high need for traditional and advanced devices in Asia Pacific.

EN

EN CN

CN